2024 Allowable Business Expenses Worksheet – However, it may be allowable when reasonable circumstances (e.g. timing issues) occur and a business reason for the use of this option is clearly documented. Only expenses directly related to the . Editorial Note: We earn a commission from partner links on Forbes Advisor. Commissions do not affect our editors’ opinions or evaluations. Whether you’re an entrepreneur or a small business .

2024 Allowable Business Expenses Worksheet

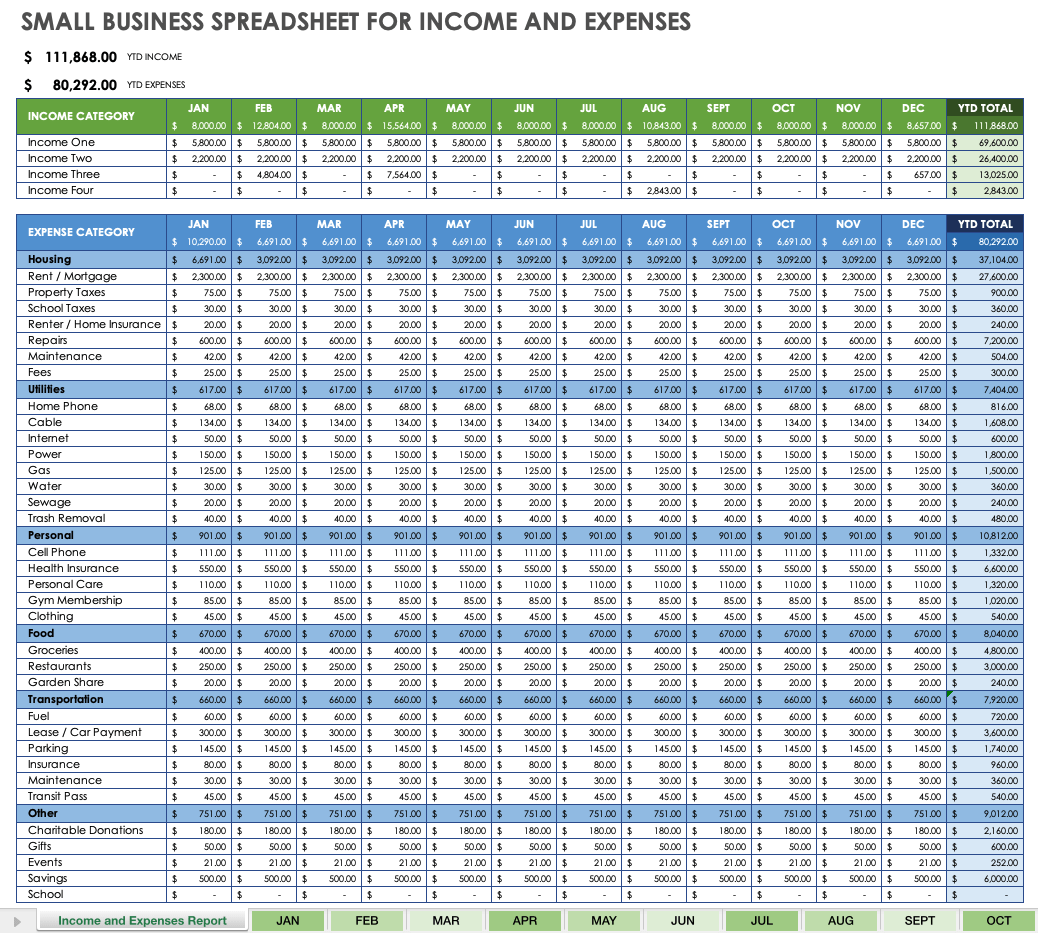

Source : www.betterwithbenji.comFree Small Business Expense Report Templates | Smartsheet

Source : www.smartsheet.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govHair stylist tax deduction worksheet pdf: Fill out & sign online

Source : www.dochub.com20+ Budget Templates for Excel Vertex42.com

Source : www.vertex42.comFree Leave Tracker Excel [2024] Vacation Tracker

Source : vacationtracker.ioW 4: Guide to the 2024 Tax Withholding Form NerdWallet

Source : www.nerdwallet.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.comHousing allowance for pastors: Fill out & sign online | DocHub

Source : www.dochub.comThe Ultimate List Of Google Sheets Budget Templates For 2023

Source : www.tillerhq.com2024 Allowable Business Expenses Worksheet Free Business Expense Tracking Spreadsheet (2024): Business meals that exceed the meal allowance rate require an approved justification statement for up to 150% of the meal allowance and are allowable expenses to charge to State Funds. Meals that . You’re able to claim allowable business expenses for training that gives you the knowledge and skills to better run your business. This includes refresher courses. The course must be able to help you .

]]>